The City of Devils Lake, ND Assessing Department

Contact

Address

423 6th St NE, PO Box 1048

Devils Lake, ND 58301

Phone

701.662.7600 Ext. 3

Duties

The Assessing Department is tasked with the fair and equitable assessment of all property within city limits for property tax purposes, per the North Dakota State Tax Department. This department also compiles records regarding real estate transactions, new construction, renovations and handles a variety of property tax exemption and credit programs through the State of North Dakota. The Assessing Department is not responsible for any special assessments. Special assessments are a function of the Finance Department.

Parcel/Property Information

To search for parcel or property information, please go to our property information website.

Devils Lake Property Information Website

Help with Property Tax Credit Applications

We are here to assist you with completing your various property tax credit applications, whether it be the Primary Residence Tax Credit, Homestead Property Tax Credit, or Disabled Veteran's Property Tax Credit. In an effort to be more accessible, the City Assessor, Rob Johnson, will be setup in the Community Room of the Lake Region Public Library from 1:00 PM to 3:00 PM on the following Fridays in January and February:

| Friday, January 9 - 1:00 PM to 3:00 PM | Friday, February 6 - 1:00 PM to 3:00 PM |

| Friday, January 16 - 1:00 PM to 3:00 PM | Friday, February 20 - 1:00 PM to 3:00 PM |

| Friday, January 23 - 1:00 PM to 3:00 PM | |

| Friday, January 30 - 1:00 PM to 3:00 PM |

If you are unable to make it to the Library, please feel free to call to setup an appointment to get assistance. Walk-ins are welcome, but assistance will depend on staff availability.

2026 Primary Residence Property Tax Credit

The application period for the 2026 Primary Residence Property Tax Credit is open. Qualifying property owners will need to reapply for the tax credit between January 1 and March 31, 2026. The application is available and must be submitted ONLINE ONLY.

For more information and to complete an online application, please go to: https://www.tax.nd.gov/prc

2026 Homestead Property Credit Applications

The application period for the 2026 Homestead Property Tax Credit is open. Qualifying property owners will need to reapply for the tax credit. More information and the application can be found on our Tax Rebate Program page.

2026 Property Assessments

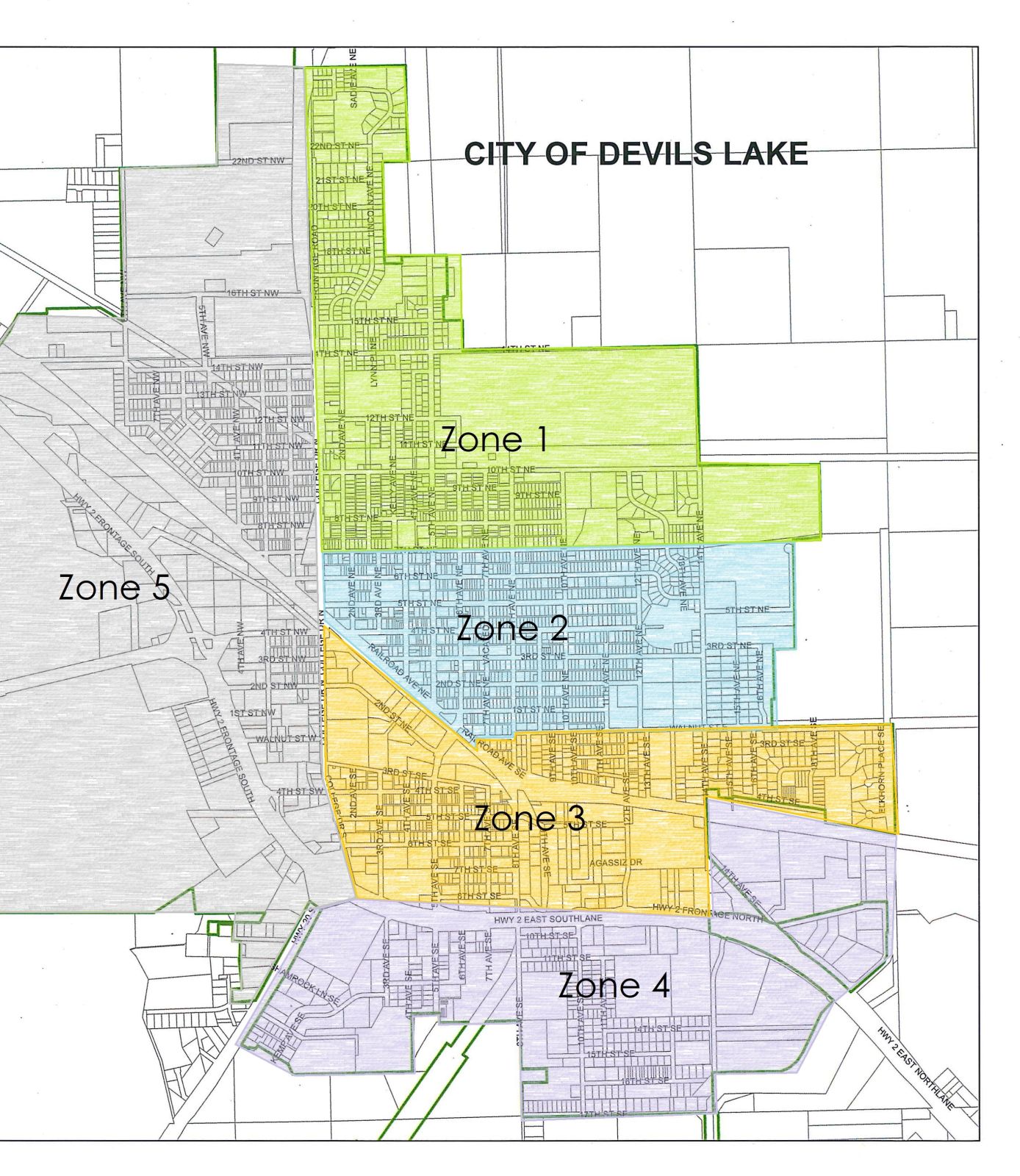

The City of Devils Lake Assessor’s Office intends to complete an in-depth review of each residential property within a five-year period. This review is necessary to make sure our office has accurate information for our analysis to set appropriate property values. In 2026 the Assessor's Office will be conducting reviews of residential properties within Zone 5 of the below map, or all residential properties west of College Drive/Highway 20. Owners in this zone can expect to receive a letter from this office in May of 2026 requesting access to the property. You can schedule the assessment by accessing the booking page linked below.

Link to Schedule your 2026 Property Assessment Coming Soon!

A review of your home requires a brief inspection of the interior and exterior by the assessor. The purpose of the inspection is to observe and list property features that affect value and will typically take less than 20 minutes.

If we are unable to review the interior of your property, the assessor will have to estimate the features and condition of the home to arrive at an estimated market value. An estimate of market value may not provide an accurate determination of the market value for assessment purposes. Assessments will be scheduled for June, July, and August between 8:00am and 4:00pm Monday through Thursday, and 8:00am to 12:00pm on Fridays, excluding holidays. You may also call 701-662-7600 ext. 3 or email robj@dvlnd.com to schedule an appointment to have the assessor review your property.

You do not have to be in the review zone to have your property inspected. If you wish to have your home reviewed by the Assessor, please call to schedule your inspection.

Residence Revitalization Program w/ Gate City Bank

We are excited to partner with Gate City Bank again in 2025 to offer up to $1 million in low interest rate loan options for eligible home improvement projects ranging from $10,000 to $100,000.

The 2025 application period has closed.